Microeconomics and Macroeconomics¶

This lecture provides mathematical models to reason about economics in the small (microeconomics) and about economics in the large (macroeconomics).

Supply, Demand, Elasticity¶

Consider a market of a single commodity with many producers and many consumers. We define the supply and the demand functions.

Naturally, demand decreases with increasing price.

Naturally, supply increases with increasing price.

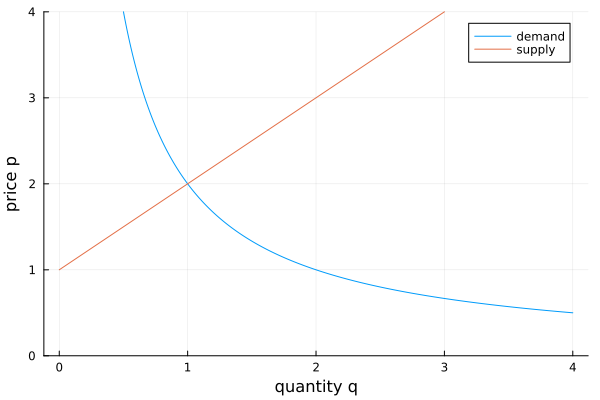

Consider a numerical example, with demand \(D(p) = 2/p\) and supply \(S(p) = p - 1\), as shown in Fig. 59.

Fig. 59 A numerical example of a supply and demand function.¶

Traditionally, the quantity \(q\) appears on the horizontal axes, so we plot \(D_q(q) = 2/q\) and \(S_q(q) = 1 + q\).

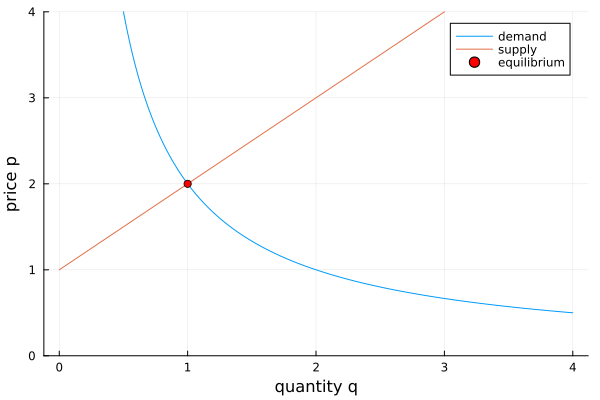

We find the equilibrium price where supply and demand intersect, as shown for an example in Fig. 60.

Fig. 60 A numerical example of the equilibrium price.¶

Prices naturally converge to the equilibrium.

At prices above the equilibrium, more goods will be produce than the market can absorb and this surplus drives down prices.

At prices below the equilibrium, when demand is higher than the supply, this scarcity will lift prices upwards.

What is the effect of a sales tax?

Supply remains, because the consumer pays the tax.

What is the new demand function?

The consumer pays \(p (1 + T)\), where \(T\) is the tax, e.g.: \(T = 10\%\). The new demand function is therefore

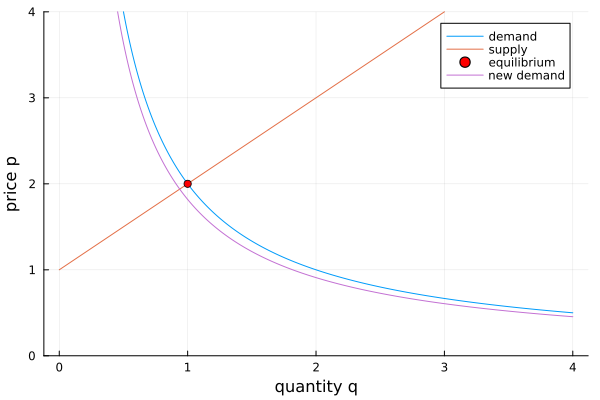

where \(D(p)\) is the original demand, before the tax. Therefore, a sales tax of \(10\%\) depresses demand. Returning to our numerical example from before, for \(D(p) = 2/p\), the new demand is \(D(p + Tp) = 2/(p+Tp) = q\), shown in Fig. 61. Observing that \(q\) is displayed on the horizontal axis, plotting \(p\) in function of \(q\), we use \(D_q(q) = 2/(q(1+T))\).

Fig. 61 The effect of a \(10\%\) sales tax on the consumer.¶

It is an exercise to consider the effect of a tax on the producer.

Given supply and demand, we next define revenue, cost, and profit.

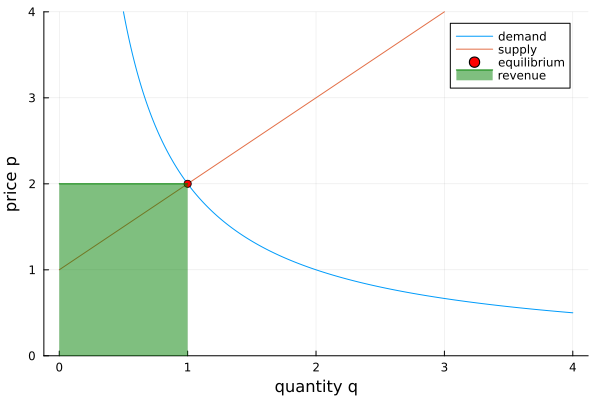

At the equilibrium price \(p_0\), the revenue is \(R(q) = p_0 q\).

The cost function increases with \(q\) and tends to flatten.

A geometric interpretation of revenue views revenue as an area, shown in Fig. 62.

Fig. 62 The revenue \(R(p,q) = p \cdot q\) as area.¶

What is the effect of a sales tax on revenue? Recall the effect of a sales tax.

The sales tax depresses the demand.

The quantity sold decreases.

The equilibrium price drops.

Consequently, the revenue \(R(p,q)\) decreases. The public sector revenue from a sales tax \(T\) is

Next we define marginal cost and marginal revenue.

For the cost function \(C(q)\) we have

The importance on marginal profit and marginal cost is summarized by the following theorem.

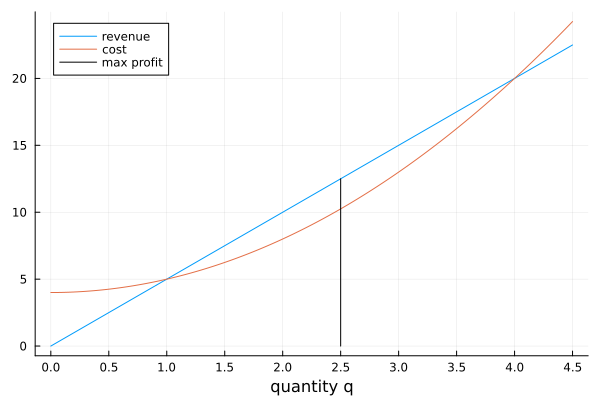

To illustrate the theorem, we consider a numerical example. Revenue \(R(q)= 5q\) while cost is \(C(q) = 4 + q^2\), illustrated in Fig. 63.

Fig. 63 Revenue, Cost, and maximum profit.¶

From Fig. 63, we see that maximum profit happens when \(R'(q) = 5 = 2q = C'(q)\), at \(q = 2.5\).

To arrive at elasticity of demand, consider the following question. By how much can a producer raise the price of a product?

What is the change in demand as the price changes?

The sign of \(e\) is negative as demand decreases for increasing price.

We next derive an expression of the elasticity.

What is the change in revenue as the price changes? Let us derive revenue as a function of elasticity.

The change in revenue in function of demand and elasticity:

Let us do a case analysis:

\(e > 1\): revenue decreases when price increases. We then say that the demand is elastic.

\(e < 1\): revenue increases when price increases. We then say that the demand is inelastic.

\(e = 1\): implies \(\displaystyle \frac{d R}{d p} = 0\), optimal revenue.

This analysis determines the price setting in a monopoly.

An exercise asks to consider elasticity for a linear demand function.

Duopolistic Competition and Price Dynamics¶

In microeconomics, we consider only one producer. Now we consider two competing producers, going to a larger scale, into macroeconomics. We make two assumptions.

The demand function is the same for both producers. For example, bottled water.

Each producer believes the other will hold its output constant. This model was proposed by Cournot in 1838.

What is the price setting mechanism?

To formalize the price dynamics, we introduce some notation. The competitors \(A\) and \(B\) have the same demand \(q = D(p)\).

Assume \(A\) is alone on the market at first. \(A\) sets the price according to elasticity \(e = 1\):

\[p = a_1 = - \frac{D(a_1)}{D'(a_1)}.\]\(B\) enters, the demand is decreased with \(q_A = D(a_1)\). The demand function for \(B\) is then \(D(p) - D(a_1)\). \(B\) sets the price according to elasticity \(e = 1\):

\[p = b_1 = - \frac{D(b_1) - D(a_1)}{D'(b_1)}.\]

Now we will be deriving a discrete time system. Rewrite

as

Now \(A\) reacts to the new demand curve \(D(p) - D(b_1)\):

which can be rewritten as

A discrete time system emerges. Assuming \(A\) is leader and \(B\) is follower, we start with

and continue for \(k = 1,2 \ldots\) with

and

This can be formulated as a fixed-point iteration, converging to an equilibrium if the equations are contractive.

The Cobb-Douglas Model of Production¶

The Cobb-Douglas model expresses production \(Q\) as a function of

\(L\), labor, and

\(K\), capital investment

where \(A\) is some constant depending on technology:

Note that \(Q = Q(L,K)\) is homogeneous. For some \(\lambda > 1\):

For example: doubling labor and capital doubles the output.

What is the effect of the addition of one extra unit of labor? This question leads to the notion of marginal product of labor. Take the derivative of \(Q\) with respect to \(L\):

is the marginal product of labor, which should equal the wage \(w\) paid to a worker.

What is the effect of the addition of one extra unit of capital? This question leads to the notion of marginal product of capital. Take the derivative of \(Q\) with respect to \(K\):

is the marginal product of capital, which should equal the rent \(r\) for capital.

Expressing production \(Q\) in function of labor \(L\) and capital \(K\):

Observe

independent of the technology \(A\). So, we derived a macroeconomic law:

In words, production is the sum of

marginal product of labor times labor, and

marginal product of capital time capital investment.

As a microeconomic application, consider the following. For a specific product made by a producer, determine in

the parameters \(A\) and \(\alpha\) by sampling and fitting. Then apply the formula \(Q = w L + r K\) as follows.

To increase production,

hire more workers if \(w > r\), or

raise more capital if \(w < r\).

The Leontiev Input/Output Model¶

The Leontiev input/output model considers three sectors:

each producing \(x_1\), \(x_2\), \(x_3\) goods respectively. \(C\) is the demand of the Consumer sector. The equation

expresses that for all goods produced by Agriculture

\(30\%\) is consumed by Agriculture,

\(20\%\) is consumed by Industry,

\(30\%\) is consumed by Service,

and the remaining 4 units are absorbed by the Consumer sector.

The three equations

can be summarized into a single matrix relation

The vector \(\bf b\) is called the bill of goods. Then the question is Is the bill of goods realizable? The question is equivalent to asking whether

has a solution with all entries in \(\bf x\) positive. The solution is \({\bf x} = (I-A)^{-1} {\bf b}\). The series expansion of \((I-A)^{-1}\) is

which converges only if \(\|A\|_2 < 1\), if the dominant eigenvalue is less than one in modulus.

Proposals of Project Topics¶

Nash equilibria.

The concept of a Nash equilibrium is important in game theory. Read the Game Theory book of Hans Peters for the definition and provide a computational description of a good example.

Consider the following questions.

Formulate an economically interesting model.

Give an example of an application with many Nash equilibria.

Model a price war.

Develop a computational model of a price war. Read chapter 11 of It’s a Nonlinear World by Richard Enns.

Consider the following questions.

Formulate a model with a plausible demand function.

Is it possible that chaos occurs?

Exercises¶

Consider \(S(p) = 20 p - 50\) and \(D(p) = 100 - 30p\). Suppose the producer must pay a specific tax of \(\$1\) per unit.

What is the before tax equilibrium price?

What is the after tax equilibrium price?

How much of the tax is then actually paid by the consumer?

Consider a linear demand function, represented by \(D(p) = q_0 - m p\).

Compute the elasticity \(e\).

For which price \(p\) is \(e = 1\)?

Consider the duopolistic competition for a linear demand function, represented by \(D(p) = q_0 - m p\).

Verify that the model converges.

What is the equilibrium price?

Bibliography¶

Richard H. Enns: It’s a Nonlinear World. Springer Undergraduate Texts in Mathematics and Technology, 2011. Chapter 11 describes nonlinear models of competition.

Charles R. MacCluer, Chapter 8 of Industrial Mathematics. Modeling in Industry, Science, and Government, Prentice Hall, 2000.

Hans Peters: Game Theory. A Multi-Leveled Approach. Springer 2008. Page 7 gives an example of a Cournot game.